The internet is breathlessly ablaze over a story detailing UBS and its plan to settle allegations over details concerning its precious metals trading. It seems like Christmas has come early in the world of gold conspiracy world.

Yet, this has an eerie quality about it once more. Why do I say that? Simple - because the entire claim of the Gold is Always Manipulated All The Time crowd ( GIAMATT) is exactly as articulated in the Paul Craig Roberts's article which I refuted in a previous post earlier in the day today. And what is that?

In his own words. Mr. Roberts claims that the big banks ( whom he refers to as 'agents of the Fed' ) are guilty of illegal activity to suppress the price of gold and discredit it. They do this by selling unlimited amounts of paper gold contracts at the Comex ( the scene of the crime according to him and those who view his pronouncements as gospel). The reason they do this is very clearly laid out -

“Eric, it’s clear, this is the Federal Reserve protecting

the value of the dollar from quantitative easing and the massive increase in the

supply of dollars and dollar-denominated debt.

This is exactly the theme that the gold price suppression scheme advocates have been claiming for years now. Those of you who remember my writings from the earlier days when gold was actually in a bull market, know that I was once a proponent of this theory. At the time, the US Dollar was sinking into oblivion and was threatening a major collapse on the price charts. Gold is the Anti-Dollar so it made perfect sense to me to give support to this view. After all, the feds have stepped into the foreign exchange markets from time to time to address currency valuations as well as form a Treasury Exchange Stabilization Fund known more commonly as the Plunge Protection Team.

However, I parted ways with some of the my former 'friends' over this when the fundamentals behind gold's move higher began to deteriorate and the bull market ended and a new bear market began. There was no longer any reason whatsoever for the feds to try to suppress the rise in the price of gold ( something which they failed to do by the way when the price hit $1900 before finally topping out for good).

Here is a series of questions that none of the gold price suppression scheme advocates will deal with honestly? Why is the Dollar no longer falling against nearly every single currency in the world? Why is the price of nearly every single commodity falling? Why is the TIPs Spread falling? Why is the Velocity of Money falling? Why are the Central Banks desperately trying to fight off Deflationary pressures and longing for their target of 2% inflation and failing to meet it? Why can anyone expect gold to be moving higher in a deflationary environment in which the price of most commodities, especially energy prices, continue to fall?

Keep in mind that none other than Jim Sinclair had written quite elegantly many years earlier about what he correctly termed the FIVE PILLARS of a BULL MARKET in Gold.

Among those are two key pillars and I quote:

1.) RISING COMMODITY PRICES

2.) A FALLING US DOLLAR

Jim noted that these were present during the great bull market of the late 1970's. Guess what? they were also present during the bull phase of gold which lasted from 2001- 2012 ( it began faltering in 2011).

Ironically or perhaps "Conveniently" would be a better choice of words, both pillars have been conspicuously ABSENT since the Dollar began its strong bull market and the commodity sector began its powerful bear market. ( see my earlier post about the charts).

Yet, those who subscribe to the gold price suppression scheme along the lines as articulated by Paul Craig Roberts, assure us that in spite of the glaring absence of two of their five pillars, the feds are still having to attack the price of gold through their agents, certain banks which are not noted specifically in the Roberts article.

Does not the open-minded reader find this odd to say the least? And I have not even touched on the interest rate component of those Five Pillars.

In other words, the US Dollar has been embarking on a powerful bull market and has gone nearly vertical since July of this year and is currently trading near a FOUR YEAR HIGH and yet Mr. Robert assures at this "attack" on gold by these "agents of the Fed" is being done in order to "protect the value of the Dollar from QE".

Strange deduction from a set of stubborn facts is it not?

But allow me to get back to the key point I wish to make - the gold price suppression scheme proponents tell us that any "illegal" activity that occurs in the Comex gold market is big banks acting as agents of the Fed to discredit the metal and to protect the value of the Dollar.

Remember this story from May of this year dealing with a rogue trader from Barclay's. I well remember it and wrote extensively about it at that time. Please see my comments on this as they are just as apropos about today's UBS story as they were back then. I will stand by my view back then just as strongly as I will stand by my view today.

http://traderdannorcini.blogspot.com/2014/05/ukraine-election-moves-to-forefront.html

The point is very simple - that large speculative forces, in my mind, mainly hedge funds, can move markets or act to influence them is nothing new in our financial markets. Sadly for those of us who prefer open and honest markets, it has been going on for years and will continue into the foreseeable future. However, to jump from that fact, that there is corruption in our financial markets, to the strained conclusion that this is evidence that the big banks are working as agents of the Fed to suppress the price of gold, is an insult to those whose minds can properly attribute cause and effect. It is especially insulting when the Dollar is the strongest currency currently in the world and the price of commodities is falling out of bed, with inflation fears sinking along with it.

If gold were in a bull market, if the Dollar was in a bear market and threatening collapse, if the commodity indices were all sharply rising with hot money flows swamping hard assets as they did a few years ago, if the mining shares were soaring higher, if the Velocity of Money was suggesting serious and possibly out-of-control inflationary forces were present, if REAL interest rates were negative, then perhaps, we could give more credence to the idea that among some of their strategies to deal with those things, an effort to slow down any sharp surge in the price of gold would carry credence with me as it once did some many years ago. Until then, the UBS story just confirms the same thing that most of us who have to make a living in these financial markets know all too well - namely, that the little guy, who is honest and plays by the rules, end up oftentimes donating to the big guys unless he or she is very nimble and can learn to stay clear of the sharks.

"When misguided public opinion honors what is despicable and despises what is honorable, punishes virtue and rewards vice, encourages what is harmful and discourages what is useful, applauds falsehood and smothers truth under indifference or insult, a nation turns its back on progress and can be restored only by the terrible lessons of catastrophe." … Frederic Bastiat

Evil talks about tolerance only when it’s weak. When it gains the upper hand, its vanity always requires the destruction of the good and the innocent, because the example of good and innocent lives is an ongoing witness against it. So it always has been. So it always will be. And America has no special immunity to becoming an enemy of its own founding beliefs about human freedom, human dignity, the limited power of the state, and the sovereignty of God. – Archbishop Chaput

Trader Dan's Work is NOW AVAILABLE AT WWW.TRADERDAN.NET

Sunday, November 9, 2014

Paul Craig Roberts and the Spread of Disinformation

Those who have been coming to this site for any length of time know that I make a point of not reading, and especially not referring my readers, to those permanently pro-gold websites which are universally permanently bullish. Almost daily at these sites, there is the propagation of so much error and misinformation when it comes to the futures market that one could spend a lifetime debunking them and still just manage to put a small dent in the sheer quantity of falsehoods emanating outwards. In even referencing them I run the risk of sending more traffic to them and helping to keep them in business; something which I am anxious not to do.

However, one recent article posted on perhaps the most egregious of these sensationalistic pro-gold websites, was so over the top and contained so much disinformation, that I feel compelled to address it directly.

I am referring to the "Shocking Interview" over at King World News ( have you noticed that nearly each and every interview there is always prefaced by an adjective in the superlative? ) where a Paul Craig Roberts, essentially accuses the "agents" ( of the Fed I suppose), also referred to as the banks, as being responsible for "illegal" activity.

Here is his claim:

Evidently Mr. Roberts is upset because the price of gold ( and silver) has been going down and in his mind, it should not be doing that. Therefore he must find a bogeyman to blame. Instead of doing what any self-respecting trader or investor would do when confronted with market action not to their expectation, he digs in deeper and concocts a scenario that reinforces his erroneous thesis and finds solace in that.

The article contains certain presuppositions that are obviously in error.

Let's start with the first one:

"Normally when a central bank creates 4 trillion new dollars, the currency collapses... It's not worth anything ( by this I assume he means the US Dollar) in terms of rubles, euros, yen or (even) pesos.

That is a rather odd statement given the sheer size of the Forex Markets and the price action of the US Dollar. Also, I find it odd that Mr. Roberts chooses to list the Russian Ruble among the currencies that that the "dollar is not worth anything in terms of".

Have any of those who are swallowing this absurd claim happened to look at a recent chart of the Russian Ruble?

Apparently his claim comes as news to the Russian monetary authorities who have been burning through their reserves ever since the sanctions imposed on it from the West have been decimating its currency. They are reported as selling large amounts of their reserves ( including dollar denominated assets) in order to stem the bleeding in their own currency.

It is evident that the Forex markets have a different view of the value of the Dollar against the Russian Ruble than does our esteemed famous currency trader, Mr. Roberts. One can only be kind and hope that he was not actually acting on this bizarre claim that the Ruble has far more value than the US Dollar and was holding a LONG position in the currency. OUCH!

Consider yet further his claim that the Dollar is not worth anything in terms of the Yen.

Here is the Yen chart. This is the Yen versus the Dollar - guess which one is winning and which one is losing.

Note to Mr. Roberts - the entirety of the massive foreign exchange markets happen to strongly disagree with you that the Dollar "is not worth anything in terms of the Yen".

We could do the same thing with the chart of the Euro but I do not want to impose any further on the patience of the reader.

It has never occurred to Mr. Roberts that the Dollar does have value in the eyes of the world's foreign exchange markets and in the world of global investors. The reason for that is simple, even if it seems lost on the hapless Roberts - in spite of its many problems, the US remains the best place for global investors looking for places in which to park capital.

Now as those of us who live in the markets well know, this could change as circumstances and events change as such is the nature of markets, but at the current time, the quaint notion that the Dollar "is not worth anything" is rather amusing, and that is being kind.

Also, Mr. Roberts has the same myopic view of the gold and silver markets as nearly all of those who are permanently bullish the precious metals do - he looks at those markets in isolation and fails to take in the larger picture.

I have demonstrated repeatedly here, to the point of fatigue, that the main problem facing the world's Central Banks is one of DEFLATION, or in their term, Disinflation. Contrary to Mr. Robert's view, it is NOT INFLATION nor is it inflation fears that keep the Central Banks of the West up at night. They would DEARLY LOVE to have this problem. After all, within the span of the last three weeks we have had THREE MAJOR Central Banks all come out with one voice stating that their goal is to generate an inflation rate of 2% annually. I am referring of course to our own Fed, the ECB and the Bank of Japan, which just announced another huge stimulus effort for the entire reason of beating back the deflationary forces which have gripped Japan for so long.

For goodness sake, that someone who once worked at the Treasury department could get something this obvious so dreadfully wrong is rather disconcerting. After all, if this is an example of the caliber of the thinking that is at our current Treasury department we are in more serious trouble than I even imagined. If those running that department cannot even identify the problem, how in the world can they ever be expected to administer the right medicine. Frightening isn't it?

Suffice it to say, the global growth is slowing, in spite of the efforts of Central Banks to reverse it. Their stimulus via QE/low interest rates/treatment of bank reserves, etc. has managed to halt the bleeding but has not in and of itself been able to generate solid, sustained economic growth. The reason for that is that monetary stimulus can in and of itself only do so much; it must be combined with sound fiscal policy and with reforms in the regulatory environment. But that is another topic for another day.

Coming back to the myopic view of Mr. Roberts - he seems genuinely bewildered by the fact that in his mind, demand for physical gold is strong in Asia and yet the metals keep going lower. He therefore jumps to the unproveable conclusion, that is must be "illegal action" that is the cause.

As stated previously, this is what happens when one gets fixated on a single market and fails to survey the entire scene. NO MARKET TRADES IN ISOLATION. If it did, it would be an easy matter for we traders to retire quite early in life. Instead we are forced to deal with winds that blow from many directions at times, each of which can impact the sector we are either attempting to trade or to invest in.

Take a look at the chart of the Goldman Sachs Commodity Index. This is an index comprised of a basket of commodities, each of which are given a particular weighting. Which direction has it been moving, higher or lower?

The answer is evident - lower; and not just lower, but sharply lower. As a matter of FACT, the index just recently hit a 50 month low. If the market is worried about inflation from QE as Mr. Robert is, it certainly is not demonstrating that now is it?

Global growth is slowing and as it slows, demand for all commodities is slowing with it, especially those used in industrial production.

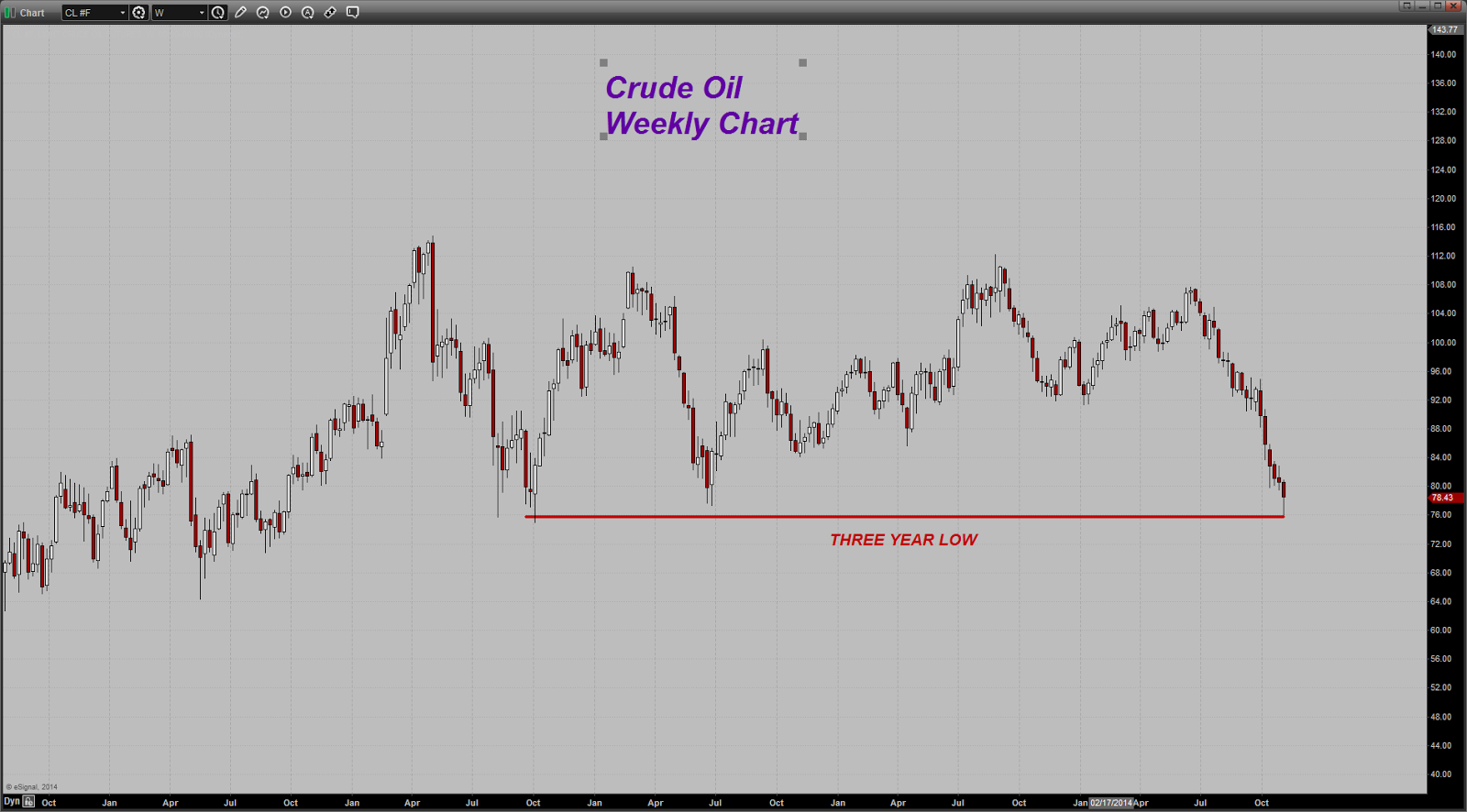

Consider a chart of crude oil, that all important key indicator of economic growth.

In spite of the fact, that oil too has been succumbing to the general deflationary impulse afflicting the global economy, Mr. Robert assures us that the only reason for lower gold and silver prices must be "illegal activity" on the paper markets.

Following is a chart of the TIPS spread that I have created which the frequent readers of this site have become quite familiar with. This is essentially the market's voice as to how it views the spectre of inflation or lack thereof. When the spread is rising, it shows the market is expecting inflation pressures to build. When it is falling, it shows the opposite, namely, that the market is not worried about inflation.

What has this spread been showing? The answer is falling inflationary fears. The spread just recently put in a multi-year low. Do you also notice the price of gold charted alongside the spread? What has it been doing? Pretty much moving right in sync with the spread, rising when it rises and falling when it falls. The relationship is not a perfect 100% one but it is rather startling how closely the price of gold tracks this all important spread from the bond markets.

Yet, in spite of this, Mr. Robert asserts, with much bravado I might add, that gold prices "are rigged" and that "the authorities are behind it".

I must say, that these authorities are rather remarkable for they have been quite busy apparently! Not only have they been dumping large amounts "into the futures markets during periods of essentially no trading" but they have singlehandedly managed to simultaneously knock down crude oil, unleaded gasoline, corn, wheat, soybeans, heating oil, copper, platinum, etc. at the same time. They have also managed to take the TIPS spread and change its entire direction, when it should be going up - based on Mr. Robert's view - instead of what it is currently doing and going down. They have also managed to push the Russian ruble lower, the yen lower, the Euro lower and nearly every other currency that exists, all against the Dollar, which they have somehow mysteriously managed to levitate in spite of the fact that in Mr. Robert's view, "it has no value".

Quite a feat is it not?

I have already dealt with the reckless claim that it is "the agents of the Fed" or "the banks" as Mr. Roberts claim which have been selling in large quantities during the early morning hours in my frequents posts over the course of the last few years here. Time constraints are precluding me from dealing with it as fully as I would like to but I would suggest that the interested reader simply go back through those many posts and examine the data for themselves.

Let me just make a quick comment along that line and note something out of the Commitment of Traders reports to refute this false claim that it is "the banks" that are the ones doing the selling during the early morning hours to "illegally" control the paper price of gold.

Here is a chart of the NET POSITION of the Commercial Category as well as the Swap Dealers. Look closely at the numbers on the left hand side of the chart and also note the location of the "Zero Line".

As you can see, those numbers are NEGATIVE. What this means, when one sees a RISING LINE for both categories of traders, is that these groups are BUYING, NOT selling, as Mr. Roberts falsely asserts, and I might add here, without the least shred of evidence to back up and support his rash claim. Perhaps he believes that if he simply says it often enough, it will become true by something akin to a reverse statue of limitations.

So then who is doing the selling? Again, what does the data tell us?

This is a chart of the HEDGE FUND NET position in the gold futures market. It has been overlaid with the price of gold showing the linkage. A falling line indicates a reduction in the number of long positions or the addition of new short positions or a combination of both, which is the actual reality. Can you see the exact and perfect correspondence between the selling of this dominant force in our markets and the price of gold? As these speculators exit the gold market in search of other opportunities or as they actively SELL it outright, the price of the metal moves lower. It is that simple.

One last thing and I am done. Mr. Roberts talks a lot about "demand exceeding supply" and as proof of that he refers to the US Mint hitting their quota of coins and the Canadian Royal Mind on "the verge of having to do that". That is all well and good and is certainly noteworthy but what about large speculative Western-based investment demand? Is coin demand the only measure of gold and/or silver demand?

What about the gold ETF and what has happened to it? Did the "agents of the Fed" go in and somehow manage to dupe all those who bought into GLD to somehow throw away their gold? Did these same "agents of the Fed" singlehandedly manage to sell the shares of nearly every single gold mining interest out there? After all, Mr. Roberts refers to the Comex as the scene of "illegal activity" but it is a demonstrably proven fact that the gold mining shares LEAD the price of bullion, whether it is up or down.

Perhaps the truth is much more simple and much less dramatic than "illegal activity on the part of the agents of the Fed". Perhaps it is the fact that with inflation fears sinking, with the Velocity of Money continuing to fall, with global economic growth floundering, with commodity prices worldwide in a general decline, with Central Banks worried about DEFLATION and with stocks being the only game in town in a near zero interest rate environment, that gold and silver have fallen out of favor with large speculative interests who get paid by generating return on capital invested.

If those interests survey the macro economic scene and believe that it is an environment not conducive to rising precious metal prices, and as a result have taken their capital out of gold and silver, and out of commodities in general, and have also decided that the best possible way to profit from them is by actively SHORTING the metals, then perhaps, that is a much easier and more reasonable explanation for the price of the metals to have fallen as they have instead of having to come up with unverifiable claims about "illegal activity".

In closing, I would only say that Mr. Roberts is entitled to believe whatever he wants and to say whatever he wants. He is not, however, entitled to no challenges to his claims.

Gold will have its day once again, but when it does, it will not be in spite of "illegal selling" or some strange suspension of the laws of supply and demand that Mr. Robert claims is occurring but rather because the stars will once again be aligned in favor of the precious metal . At that time the fundamental factors will both dictate higher prices and attract the capital flows from large investors that is necessary for a bull market.

However, one recent article posted on perhaps the most egregious of these sensationalistic pro-gold websites, was so over the top and contained so much disinformation, that I feel compelled to address it directly.

I am referring to the "Shocking Interview" over at King World News ( have you noticed that nearly each and every interview there is always prefaced by an adjective in the superlative? ) where a Paul Craig Roberts, essentially accuses the "agents" ( of the Fed I suppose), also referred to as the banks, as being responsible for "illegal" activity.

Here is his claim:

Apparently these (agent) banks

can print gold futures contracts in unlimited amounts, just as the Federal

Reserve can print U.S. dollars in unlimited amounts. And then in the space of a

minute, two, three, or four minutes, dump the equivalent of 20, 30, 40 (or more)

tons of gold as represented by these paper claims to gold into the futures

markets during periods of essentially no trading. The favorite time is around 3

o’clock in the morning EST. It’s almost always when the Asian physical markets

are closed.

That’s exactly what’s going on. It’s illegal. It’s not

merely unethical -- it’s strictly illegal. But it’s being done by the

authorities, or with their permission."

The article contains certain presuppositions that are obviously in error.

Let's start with the first one:

"Normally when a central bank creates 4 trillion new dollars, the currency collapses... It's not worth anything ( by this I assume he means the US Dollar) in terms of rubles, euros, yen or (even) pesos.

That is a rather odd statement given the sheer size of the Forex Markets and the price action of the US Dollar. Also, I find it odd that Mr. Roberts chooses to list the Russian Ruble among the currencies that that the "dollar is not worth anything in terms of".

Have any of those who are swallowing this absurd claim happened to look at a recent chart of the Russian Ruble?

Apparently his claim comes as news to the Russian monetary authorities who have been burning through their reserves ever since the sanctions imposed on it from the West have been decimating its currency. They are reported as selling large amounts of their reserves ( including dollar denominated assets) in order to stem the bleeding in their own currency.

It is evident that the Forex markets have a different view of the value of the Dollar against the Russian Ruble than does our esteemed famous currency trader, Mr. Roberts. One can only be kind and hope that he was not actually acting on this bizarre claim that the Ruble has far more value than the US Dollar and was holding a LONG position in the currency. OUCH!

Consider yet further his claim that the Dollar is not worth anything in terms of the Yen.

Here is the Yen chart. This is the Yen versus the Dollar - guess which one is winning and which one is losing.

Note to Mr. Roberts - the entirety of the massive foreign exchange markets happen to strongly disagree with you that the Dollar "is not worth anything in terms of the Yen".

We could do the same thing with the chart of the Euro but I do not want to impose any further on the patience of the reader.

It has never occurred to Mr. Roberts that the Dollar does have value in the eyes of the world's foreign exchange markets and in the world of global investors. The reason for that is simple, even if it seems lost on the hapless Roberts - in spite of its many problems, the US remains the best place for global investors looking for places in which to park capital.

Now as those of us who live in the markets well know, this could change as circumstances and events change as such is the nature of markets, but at the current time, the quaint notion that the Dollar "is not worth anything" is rather amusing, and that is being kind.

Also, Mr. Roberts has the same myopic view of the gold and silver markets as nearly all of those who are permanently bullish the precious metals do - he looks at those markets in isolation and fails to take in the larger picture.

I have demonstrated repeatedly here, to the point of fatigue, that the main problem facing the world's Central Banks is one of DEFLATION, or in their term, Disinflation. Contrary to Mr. Robert's view, it is NOT INFLATION nor is it inflation fears that keep the Central Banks of the West up at night. They would DEARLY LOVE to have this problem. After all, within the span of the last three weeks we have had THREE MAJOR Central Banks all come out with one voice stating that their goal is to generate an inflation rate of 2% annually. I am referring of course to our own Fed, the ECB and the Bank of Japan, which just announced another huge stimulus effort for the entire reason of beating back the deflationary forces which have gripped Japan for so long.

For goodness sake, that someone who once worked at the Treasury department could get something this obvious so dreadfully wrong is rather disconcerting. After all, if this is an example of the caliber of the thinking that is at our current Treasury department we are in more serious trouble than I even imagined. If those running that department cannot even identify the problem, how in the world can they ever be expected to administer the right medicine. Frightening isn't it?

Suffice it to say, the global growth is slowing, in spite of the efforts of Central Banks to reverse it. Their stimulus via QE/low interest rates/treatment of bank reserves, etc. has managed to halt the bleeding but has not in and of itself been able to generate solid, sustained economic growth. The reason for that is that monetary stimulus can in and of itself only do so much; it must be combined with sound fiscal policy and with reforms in the regulatory environment. But that is another topic for another day.

Coming back to the myopic view of Mr. Roberts - he seems genuinely bewildered by the fact that in his mind, demand for physical gold is strong in Asia and yet the metals keep going lower. He therefore jumps to the unproveable conclusion, that is must be "illegal action" that is the cause.

As stated previously, this is what happens when one gets fixated on a single market and fails to survey the entire scene. NO MARKET TRADES IN ISOLATION. If it did, it would be an easy matter for we traders to retire quite early in life. Instead we are forced to deal with winds that blow from many directions at times, each of which can impact the sector we are either attempting to trade or to invest in.

Take a look at the chart of the Goldman Sachs Commodity Index. This is an index comprised of a basket of commodities, each of which are given a particular weighting. Which direction has it been moving, higher or lower?

The answer is evident - lower; and not just lower, but sharply lower. As a matter of FACT, the index just recently hit a 50 month low. If the market is worried about inflation from QE as Mr. Robert is, it certainly is not demonstrating that now is it?

Global growth is slowing and as it slows, demand for all commodities is slowing with it, especially those used in industrial production.

Consider a chart of crude oil, that all important key indicator of economic growth.

In spite of the fact, that oil too has been succumbing to the general deflationary impulse afflicting the global economy, Mr. Robert assures us that the only reason for lower gold and silver prices must be "illegal activity" on the paper markets.

Following is a chart of the TIPS spread that I have created which the frequent readers of this site have become quite familiar with. This is essentially the market's voice as to how it views the spectre of inflation or lack thereof. When the spread is rising, it shows the market is expecting inflation pressures to build. When it is falling, it shows the opposite, namely, that the market is not worried about inflation.

What has this spread been showing? The answer is falling inflationary fears. The spread just recently put in a multi-year low. Do you also notice the price of gold charted alongside the spread? What has it been doing? Pretty much moving right in sync with the spread, rising when it rises and falling when it falls. The relationship is not a perfect 100% one but it is rather startling how closely the price of gold tracks this all important spread from the bond markets.

Yet, in spite of this, Mr. Robert asserts, with much bravado I might add, that gold prices "are rigged" and that "the authorities are behind it".

I must say, that these authorities are rather remarkable for they have been quite busy apparently! Not only have they been dumping large amounts "into the futures markets during periods of essentially no trading" but they have singlehandedly managed to simultaneously knock down crude oil, unleaded gasoline, corn, wheat, soybeans, heating oil, copper, platinum, etc. at the same time. They have also managed to take the TIPS spread and change its entire direction, when it should be going up - based on Mr. Robert's view - instead of what it is currently doing and going down. They have also managed to push the Russian ruble lower, the yen lower, the Euro lower and nearly every other currency that exists, all against the Dollar, which they have somehow mysteriously managed to levitate in spite of the fact that in Mr. Robert's view, "it has no value".

Quite a feat is it not?

I have already dealt with the reckless claim that it is "the agents of the Fed" or "the banks" as Mr. Roberts claim which have been selling in large quantities during the early morning hours in my frequents posts over the course of the last few years here. Time constraints are precluding me from dealing with it as fully as I would like to but I would suggest that the interested reader simply go back through those many posts and examine the data for themselves.

Let me just make a quick comment along that line and note something out of the Commitment of Traders reports to refute this false claim that it is "the banks" that are the ones doing the selling during the early morning hours to "illegally" control the paper price of gold.

Here is a chart of the NET POSITION of the Commercial Category as well as the Swap Dealers. Look closely at the numbers on the left hand side of the chart and also note the location of the "Zero Line".

As you can see, those numbers are NEGATIVE. What this means, when one sees a RISING LINE for both categories of traders, is that these groups are BUYING, NOT selling, as Mr. Roberts falsely asserts, and I might add here, without the least shred of evidence to back up and support his rash claim. Perhaps he believes that if he simply says it often enough, it will become true by something akin to a reverse statue of limitations.

So then who is doing the selling? Again, what does the data tell us?

This is a chart of the HEDGE FUND NET position in the gold futures market. It has been overlaid with the price of gold showing the linkage. A falling line indicates a reduction in the number of long positions or the addition of new short positions or a combination of both, which is the actual reality. Can you see the exact and perfect correspondence between the selling of this dominant force in our markets and the price of gold? As these speculators exit the gold market in search of other opportunities or as they actively SELL it outright, the price of the metal moves lower. It is that simple.

One last thing and I am done. Mr. Roberts talks a lot about "demand exceeding supply" and as proof of that he refers to the US Mint hitting their quota of coins and the Canadian Royal Mind on "the verge of having to do that". That is all well and good and is certainly noteworthy but what about large speculative Western-based investment demand? Is coin demand the only measure of gold and/or silver demand?

What about the gold ETF and what has happened to it? Did the "agents of the Fed" go in and somehow manage to dupe all those who bought into GLD to somehow throw away their gold? Did these same "agents of the Fed" singlehandedly manage to sell the shares of nearly every single gold mining interest out there? After all, Mr. Roberts refers to the Comex as the scene of "illegal activity" but it is a demonstrably proven fact that the gold mining shares LEAD the price of bullion, whether it is up or down.

Perhaps the truth is much more simple and much less dramatic than "illegal activity on the part of the agents of the Fed". Perhaps it is the fact that with inflation fears sinking, with the Velocity of Money continuing to fall, with global economic growth floundering, with commodity prices worldwide in a general decline, with Central Banks worried about DEFLATION and with stocks being the only game in town in a near zero interest rate environment, that gold and silver have fallen out of favor with large speculative interests who get paid by generating return on capital invested.

If those interests survey the macro economic scene and believe that it is an environment not conducive to rising precious metal prices, and as a result have taken their capital out of gold and silver, and out of commodities in general, and have also decided that the best possible way to profit from them is by actively SHORTING the metals, then perhaps, that is a much easier and more reasonable explanation for the price of the metals to have fallen as they have instead of having to come up with unverifiable claims about "illegal activity".

In closing, I would only say that Mr. Roberts is entitled to believe whatever he wants and to say whatever he wants. He is not, however, entitled to no challenges to his claims.

Gold will have its day once again, but when it does, it will not be in spite of "illegal selling" or some strange suspension of the laws of supply and demand that Mr. Robert claims is occurring but rather because the stars will once again be aligned in favor of the precious metal . At that time the fundamental factors will both dictate higher prices and attract the capital flows from large investors that is necessary for a bull market.

Subscribe to:

Posts (Atom)